This cover story is presented by Life in Indy. From exploring Indy’s top attractions to connecting with leading employers, Life in Indy is the go-to resource on all things central Indiana. Visit the Life in Indy website for a virtual tour experience and explore our community!

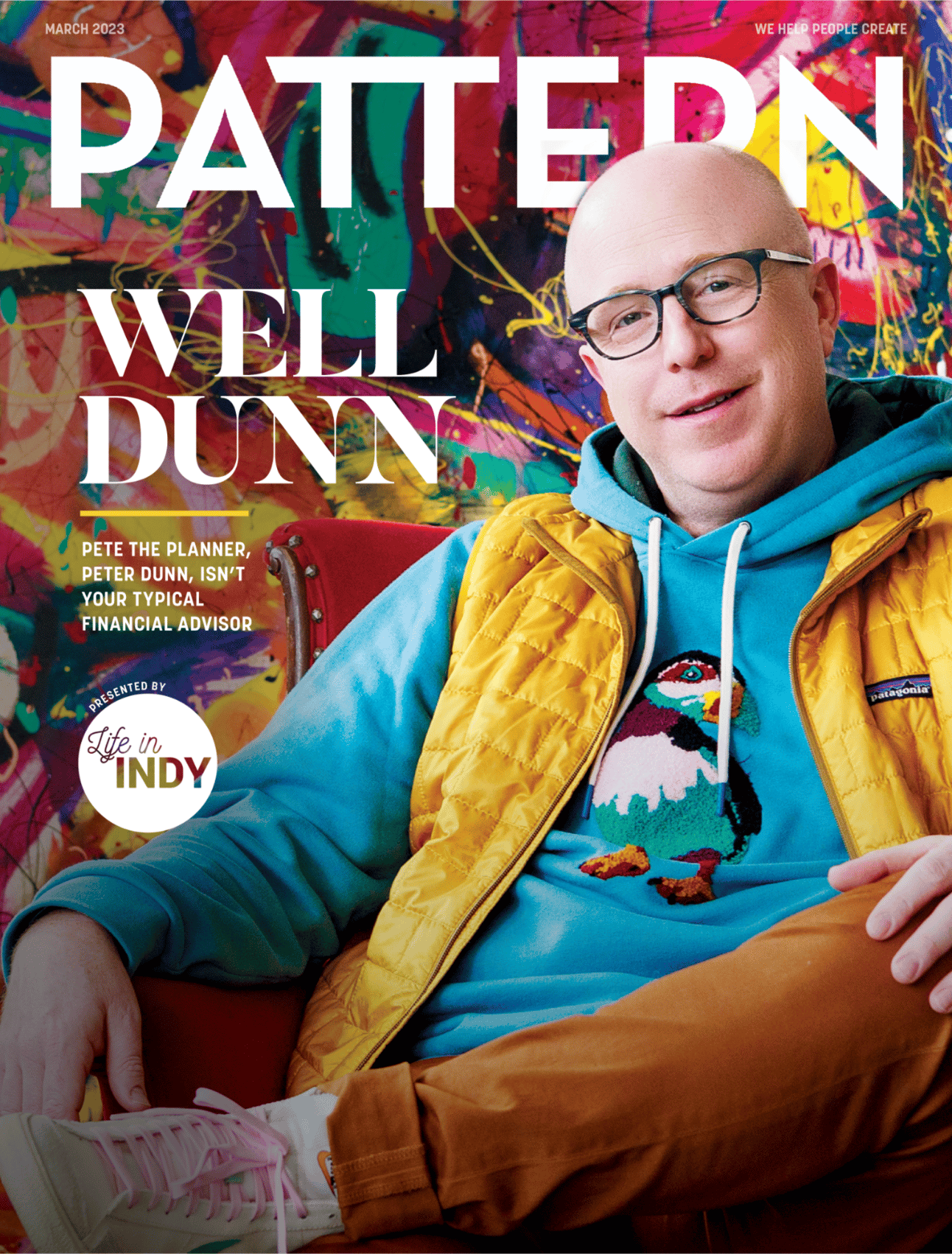

Well Dunn: Pete the Planner, Peter Dunn, Isn't Your Typical Financial Advisor

Photography by Brandon Wright

It’s that time of year again—tax season is approaching, and for many, financial fear is beginning to creep in. This month at PATTERN, we’ll be talking about all things money. We had to start by inviting nationally-recognized financial guru Peter Dunn, AKA Pete the Planner, into the office to share his fiscal wisdom.

Dunn has been in the game for years, having examined the financial lives of over 25,000 people. He’s everywhere: Dunn is the author of ten books, a columnist for USA Today, and the host of Pete the Planner Show, which is both a radio show and podcast. He’s also the CEO and founder of Your Money Line, a company dedicated to effectively untangling financial lives through one-on-one guidance. Basically, he knows his shit.

We sat down with Dunn to pick his brain on everything from tax season tips to money management for creatives. If you’re a creative in your twenties or thirties, consider this your financial guidebook!

Photography by Brandon Wright; Cover Design by Lindsay Hadley

Katie Freeman: Money! It’s a scary subject for plenty of people, creatives included.

Peter Dunn: You’ve gotta extend yourself a lot of grace when you’re learning about money. There’s a lot of pressure. It brings joy. It can solve problems. But the reality is that you are going to make a finite amount of money in your lifetime. Not only does it have to serve you now, but it has to provide for you when a job can’t. Understandably, people struggle with that.

There are two economic resources: money and time. I find that people who struggle with time also struggle with money. You have to see it as a finite thing—and by the way, that’s not a scarcity mentality. People love an abundance mentality, like “I can always go make more. The world is my oyster!” I’m all for that, but the reality is that those resources are still finite.

KF: When did you first have that realization?

PD: 2005, oddly. I was a financial advisor and I met with new clients, both of whom were attorneys at downtown law firms. They were collectively making around $700,000 a year, and they were a disaster. They couldn’t do anything. It hit me that I either had to fix these people so they would become good clients for me to invest their money, or I had to go find other people that made $700,000. That’s when the Pete the Planner stuff started. I thought, “What if I work on people’s brains as it relates to money, as opposed to just managing the money they have?”

KF: And to shift people’s perspectives on money, you prefer a one-on-one, conversational approach, right?

PD: Money is so personal. People feel so judged, right? I can sit across from someone and show some empathy. I understand money, but I have other behavioral challenges that I always tap into when I’m talking to someone about their money. I think, “What do I struggle with?” It seems obvious to a lot of other people. But we don’t shame beginnings. So many people are at this financial beginning and they feel shame, so they don’t take the next step.

KF: What does that conversation look like with Your Money Line?

PD: If you think about your financial life on a scale of one through ten in terms of complexity, one would be opening your first bank account. Ten is private equity investments and estate planning. Most Americans need help with one through seven. Financial planners do eight through ten. Your Money Line helps with one through seven. We solve BS, like “Hey, I was in a relationship. We broke up. They left the apartment. They made most of the money. What do I do?”

Employers pay us to come in and solve their people’s problems. The reality is—although it’s the right thing to do—if you’re an employee and you’re struggling financially, you’re not on point. Your productivity is down, your healthcare costs are up, and you’re more likely to leave that organization and go get a higher-paid job. So we align employers and employees in that regard.

KF: Did you ever struggle with money?

PD: I was born on third base, if we’re being honest. I think that’s an important part of the work we do, that I grew up in an upper-middle-class family and didn’t pay for my college. Early on in my marriage and career, we probably had a few thousand dollars in credit card debt, and we figured it out. I’ve struggled with other things, and that’s what I have to tap into. People in the financial world—even wealth management—love to close the door behind them. I’m just not interested in that. I like the idea that you can change a person’s finances, and it may change generations for them.

KF: For creatives, it can become difficult to manage money when income is unstable. Do you have any advice for people who are self-employed and have varying amounts coming in from month to month?

PD: Managing money when you don’t know how much is coming in is actually the hardest thing to do. If you’re in the gig economy, oftentimes you just try to get more money. But each of the gigs—each of the sources of money—don’t have a role in your budget. What you end up doing is forcing yourself to take on more gigs to always make more money. Then, you can’t subtract the gigs because your lifestyle matches your income. But you should designate each gig to pay for a certain thing.

I lived on commission income for ten years of my career. It was always unsteady that way, and I had to create that system for myself. What’s interesting about the Midwest is that a lot of people go out and hustle. They’ll get a second job, like Uber. It’s that second job that kills them financially because they grow how much money they have to spend. They spend more money as opposed to, say, “I’m going to pay off the student loan and then I’m going to stop driving for DoorDash.”

The other idea is learning exactly what your minimum budget is, and then pooling the rest of the money that’s over that. You create this pool that is used to pay yourself a salary.

KF: How would somebody break out of a situation like that, where they have to work multiple gigs to maintain the income flow they need?

PD: There’s gotta be a little bit of a detox. People love to try that as a New Year’s resolution. I’m of the belief that we catch about two financial breaks a year. Maybe tax time is a break because you might get a tax refund. The other one is when something good happens. Either use that unexpected break you catch to springboard you, or plan ahead if you know a break is coming. If you know you’re getting a tax refund in forty-five days, get your shit together now. Then, when that day comes, the money is like a reward and it takes you even further. Often, I think people don’t time the detox right. They just get the idea, and they try it, and can’t stick to it. The other thing is—and this is not fun to hear—your friend group matters. It’s got to be a positive financial culture, not one where you’re just outdoing each other with dumb ideas.

KF: Though, tax season isn’t as much of a break when you’re self-employed and end up owing the government money. What’s your advice for those filing 1099s?

PD: Creatives are completely different when it comes to taxes. The second you get a paycheck, you have to put twenty percent away for taxes. It has to be a separate tax account. Do not have that in your checking account. No excuses. That twenty percent is non-negotiable. Then there’s still another ten percent you’re saving for yourself. That is a tough pattern. I used the magazine’s name there! [laughter] Sorry. That was awful. I’m embarrassed. But there is this pattern that people get caught into these tax traps. If you put twenty percent off to the side, the best case scenario is that you don’t need all the money. You give yourself a refund or it becomes your savings and you keep going. Tax troubles can be so stressful—you don’t want to be there, and a lot of creatives end up there.

KF: What’s the biggest mistake you think people make with their money?

PD: I don’t think of things like mistakes when it comes to money. We just have to make sure that we view it as a finite resource. I don’t believe stuff like, “Don’t go to Starbucks every day, you’re wasting your money.” Maybe that $6 drink was the best part of your week.

Try not to forget that you’re going to have to fund your own future. Our grandparents had a pension—you and I don’t have that. We don’t have certainty, we have chaos. So we need to create our own stability.

KF: On the other hand, what’s a great financial habit to have?

PD: I have a friend who’s a barber. Every day he’s cut hair since he was twenty-five years old, he set aside ten dollars. He ended up buying his building in cash. It’s this idea that every day, you’re actually setting aside money. Whatever your paycheck is, move the decimal point one place to the left. That’s ten percent. That’s the bare minimum of what you should set aside.

Don’t get caught up in “Well, what should I save it for?” That’s not the point. It’s about making sure you’re not spending one hundred percent of your income. With this setup, you’re dependent on ninety percent, not one hundred percent. Then next year, the goal is to be dependent on eighty-nine percent. And the goal for the next is to be eighty-eight percent. You break your dependency on one hundred percent of your income. That’s how you will be able to retire.

KF: When exactly should we start saving for retirement?

You’re going to hate my answer. It’s immediately. The hardest thing that you and I will do is retire. That’s strange to hear, because you always think the more years you’re in the workforce, the more you’re gonna figure out money. Just because you experience it doesn’t mean it gets easier. You should be always breaking off towards retirement to make it easier on yourself.

I don’t have a ton of financial regrets, but the ones I do have revolve around ages twenty-two to twenty-eight, when I didn’t put as much as I should have towards retirement. It shouldn’t need to be dramatic—it can be putting one hundred dollars a month into a Roth IRA. People don’t start because they think you need to put $1,000 away here and there.

KF: Does it matter where that money is set aside? Is there a difference between putting it in the glass jar in your room or a Roth IRA or some kind of high-yield savings account?

PD: Wherever you won’t touch it. That’s different for everybody. I have to put it in a savings account at a bank where I don’t have a checking account linked. I want for barrier to entry. If your savings account is linked to your checking account, you find that you’re constantly moving them back and forth. Some people like online bank accounts, some people like a drawer.

KF: If we need to cut costs, where is the best area to focus on budgeting and saving money?

I think housing is where people make the biggest mistake. If your housing costs over thirty percent of your take-home pay, then the rest of your money has so much work to do. We live in Indiana—this is not Manhattan. Having roommates and sharing rent can make sense. Don’t think you can’t do things like going out to eat. I think gigging is where you can take out massive problems, when done right. You can use gigs to pay for student loan debt. I write for newspapers and whatnot, and a radio show. Those are gigs. They’re going to go straight to my kid’ college education, and that’s it.

KF: Any last-minute money advice you want to add?

PD: Most people need an accountability partner. In the creative space, it’s important to have an accountability partner to understand what you’re going through. Note that sometimes your partner in life isn’t the best accountability partner for you. With a 1099, it’s so easy to feel like you’re alone financially and that traditional financial advice doesn’t apply to you. I think that’s why you need community to help you there.

When you think about success, financial success seems to be the primary thing people think about. It’s okay to measure yourself with a different metric of success. I think creatives do understand that they’re doing something they love. There’s real value to that, and so not everything is about money!

Stay Connected

PATTERN is a 501(c)(3) public charity. Your donations make our work possible.

Subscribe to our Print Magazine and support creatives across the state.

Love our work? Hire us! We’re obsessed with storytelling and design. Email [email protected] with details for a quote.

This story was made possible thanks to the generous support of our friends at Life in Indy.